Full AP Automation in Latin America, Now Possible with Oracle AI.

ITCROSS cuts Accounts Payable Processing time from hours to seconds achieving complete tax compliance.

The challenge

Understanding how AI is truly transforming finance can be difficult—especially in complex scenarios, such as when global companies expand into Latin America. Here, diverse local regulations and legal requirements make it challenging to replicate headquarters’ processes in full.

For years, global finance leaders have struggled to achieve high levels of automation and user satisfaction in overseas locations. There was always a portion of local data that had to be entered manually. In other words, processes fully automated at headquarters—delivering efficiency and reducing risk—were only partially implemented in Latin America. The result? Persistent manual tasks, higher risk of errors, and time-consuming workflows.

Can Oracle AI help finance teams overcome these cross-border hurdles, simplify compliance, and achieve true end-to-end automation? According to Gartner, 90% of CFOs plan to increase their AI budgets—clear evidence that AI isn’t just a passing trend, but a game changer for the future of finance.

Great news: Embedded AI features in Oracle Fusion Cloud ERP

Oracle Fusion Financials Cloud includes a wide range of embedded AI capabilities designed to streamline and enhance financial operations. These features are built right into the ERP applications—no extra integrations required—helping finance teams work smarter, faster, and with greater accuracy.

Watch the video below for an overview of these powerful AI functionalities:

Oracle AI That Takes AP Invoice Processing to the Next Level.

Oracle Cloud Platform offers more than just embedded AI in its Financials applications—it also delivers advanced AI capabilities that can enhance tax integrations.

At ITCROSS, we’re leveraging Oracle AI in complex tax integrations for countries such as Mexico, Argentina, Chile, and others. This powerful tool automatically uploads tax codes and electronic invoice requirements, streamlining compliance and eliminating manual entry.

When combined with OracleIntegrationCloud service, Oracle AI new feature captures and processes vendors’ invoices seamlessly—delivering faster processing times, fewer errors, and greater efficiency.

How exactly does Oracle AI applied to tax integration work?

It’s an Oracle AI service that enables developers to extract text, tables, and other key data from document files through APIs and command line interface tools. You can automate tedious business processing tasks with prebuilt AI models and customize document extraction to fit your industry-specific needs.

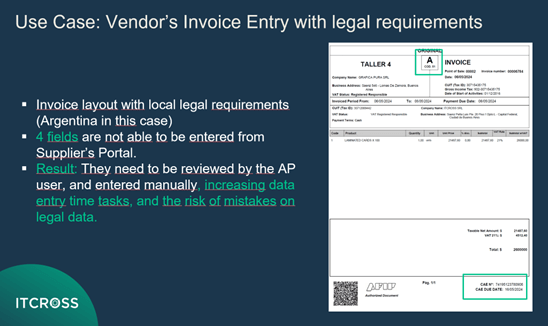

Argentina Use Case: Vendor Invoices with Mandatory Tax Codes

The example below shows a real-life scenario in Argentina: when an AP invoice is uploaded using standard ERP capabilities—such as the Supplier’s Portal—certain mandatory local information is not captured.

As a result, AP users must manually review the uploaded invoice, compare it with the original paper copy, and enter four additional data points to ensure tax records and reports are accurate. This extra step not only slows down the process but also increases the risk of human error.

One of the key advantages of Oracle AI is that it can be trained. By feeding the AI Console with sample vendor invoices, we can identify and map exactly where the tax codes appear. These mappings are then updated using Oracle Integration Cloud and Fusion APIs to populate the ERP tables.

This pre-training phase is where the AI truly shines—achieving near-perfect accuracy (almost 100%) with fewer than 50 sample invoices. Because this process happens before any real invoice is uploaded, there’s no need for testing or adjustments during transaction entry. The results are remarkably precise and a significant improvement over traditional technologies.

ITCROSS Solution Impact on the business.

• With our solution, AP invoice processing time drops from hours to just seconds.

• Tax codes are automatically captured and applied during integration, eliminating compliance risks caused by manual errors.

• By removing repetitive data-entry tasks, AP teams can focus on higher-value, analytical work that drives business insights.

• For the first time, finance teams in Latin America can achieve the same 100% AP process automation enjoyed at headquarters—gaining unmatched efficiency, accuracy, and compliance.

The Opportunity with ITCROSS.

ITCROSS helps global companies implement and support Oracle Fusion Cloud ERP and JD Edwards in North America, rolling out the ERPs across Latin America and Europe—powered by Oracle AI for smarter automation and compliance.

Our team specializes in solving regional compliance challenges by addressing complex localization and integration requirements.

Our rollout approach involves automation, AI and ITCROSS fiscal solutions, and seeks to simplify implementation risks while ITCROSS’ support services are tailored to fit headquarters as well as worldwide locations’ needs.

In addition, ITCROSS has more than 20 years’ experience working with global Oracle customers in several industries, such as Financial Services, Distribution&Logistics, Plastics, Packaging, Real Estate, Retail, and more.

Know more about AP Automation here.